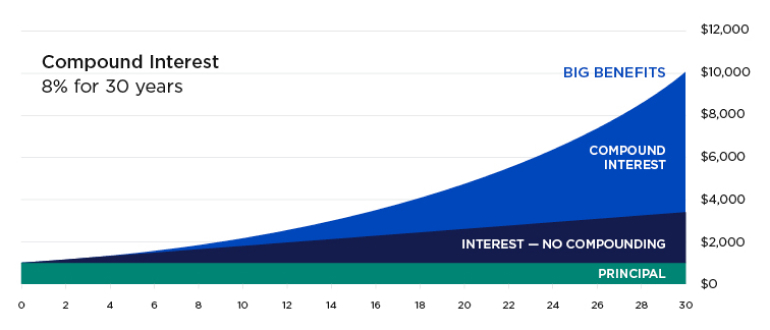

Compounding can be a powerful engine for account growth

Compounding adds up

How it works in your retirement account

When you contribute to your retirement account, you allocate that money to be invested in various options available through the plan. Those options may include mutual funds, stable value funds and fixed interest accounts.

For this example, let’s assume you’ve allocated your assets to a mutual fund, an investment vehicle that pools money from many investors and invests it in securities such as stocks and bonds.

- Stocks are shares of ownership in a corporation that entitles the owner to a proportion of its assets and profits. Those earnings are typically paid as dividends.

- Bonds are essentially loans issued by governments and corporations, which agree to regularly pay interest.

The dividends and interest that the mutual fund receives from the stocks and bonds it holds are used to pay returns to investors. These returns are reinvested in the fund for as long as the investor holds it, allowing the returns to compound each time earnings are paid.

This process of compounded earnings, repeated with each asset you invest in, could help you significantly grow your retirement account over the long term. Bear in mind, however, that all investing is subject to risk. No investment strategy, including compounding, can ensure a profit or protect against a loss, especially in a down market.